Failure to pass on GST savings — an overlooked cost in some novated leases

In Australia, most goods and services attract a 10% Goods and Services Tax (GST).

For example:

- you pay $110 for an item,

- $100 is the base price,

- $10 is GST.

Under a typical novated lease arrangement, this GST should not be a real cost to you.

But that assumption is not universally true.

When GST savings are not passed on, every running cost becomes about 10% more expensive than it needs to be, quietly eroding the benefit of the novated lease.

How GST savings normally work in a novated lease

Under most novated lease arrangements:

- your employer can claim input tax credits (ITC) for the GST incurred on running costs such as:

- fuel,

- insurance,

- servicing,

- maintenance,

- those GST credits are then passed on to you, meaning:

- you effectively pay only the GST-exclusive amount

- funded using pre-tax income from your salary.

Example: when GST savings are passed on

Suppose you pay $11 for a car wash:

- $10 base cost

- $1 GST

If your employer passes on the GST credit:

- you effectively only pay the $10 base cost,

- funded using pre-tax income from your salary.

If you are on the top marginal tax bracket (45% + 2% Medicare levy):

- take-home cost = $10 × (1 − 47%) = $5.30

The GST component has effectively disappeared.

This is how novated leases are usually expected to work.

What happens when GST savings are not passed on

Some employers choose not to pass on the GST input tax credit.

In effect:

- the employer may still claim the GST credit from ATO, but keeps it, and

- you pay the full GST-inclusive amount, even though it is funded pre-tax.

Using the same $11 car wash example:

- you now pay the full $11 using pre-tax income from your salary,

- at the top tax bracket:

- take-home cost = $11 × (1 − 47%) = $5.83

That is a 10% increase in effective cost, purely because the GST credit was not passed on.

Why this matters

Failing to pass on GST credits means:

- all running costs become 10% more expensive than they should be,

- every fuel fill, service, tyre replacement, and insurance premium is affected,

- the cumulative impact over a multi-year lease can be material.

Over a five-year lease, this can amount to thousands of dollars of unnecessary extra cost.

This erodes the “savings” people expect from novated leasing.

Where this is most commonly seen

Anecdotally, this practice appears more common in some Victorian public hospitals.

That does not mean it is universal, but it is common enough to warrant explicit checking in your quote.

Many employees assume GST savings are automatic, but they are not.

How to tell if GST savings are being passed on

You can often infer this directly from your novated lease quote.

Example 1: GST savings not passed on

Red flags include:

- costs described as “inc GST” with no adjustment

- no line item showing GST refunds or credits

- no reduction in running-cost figures implying GST removal

Numerical tell:

- marginal tax rate for this person: 32% (30% + 2%)

- pre-tax deduction: $22,804.92

- after-tax cost: $15,507.34

$15,507.34 ÷ $22,804.92 ≈ 68%

→ income tax only, no GST benefit derived

Conclusion: GST credits are not being passed on.

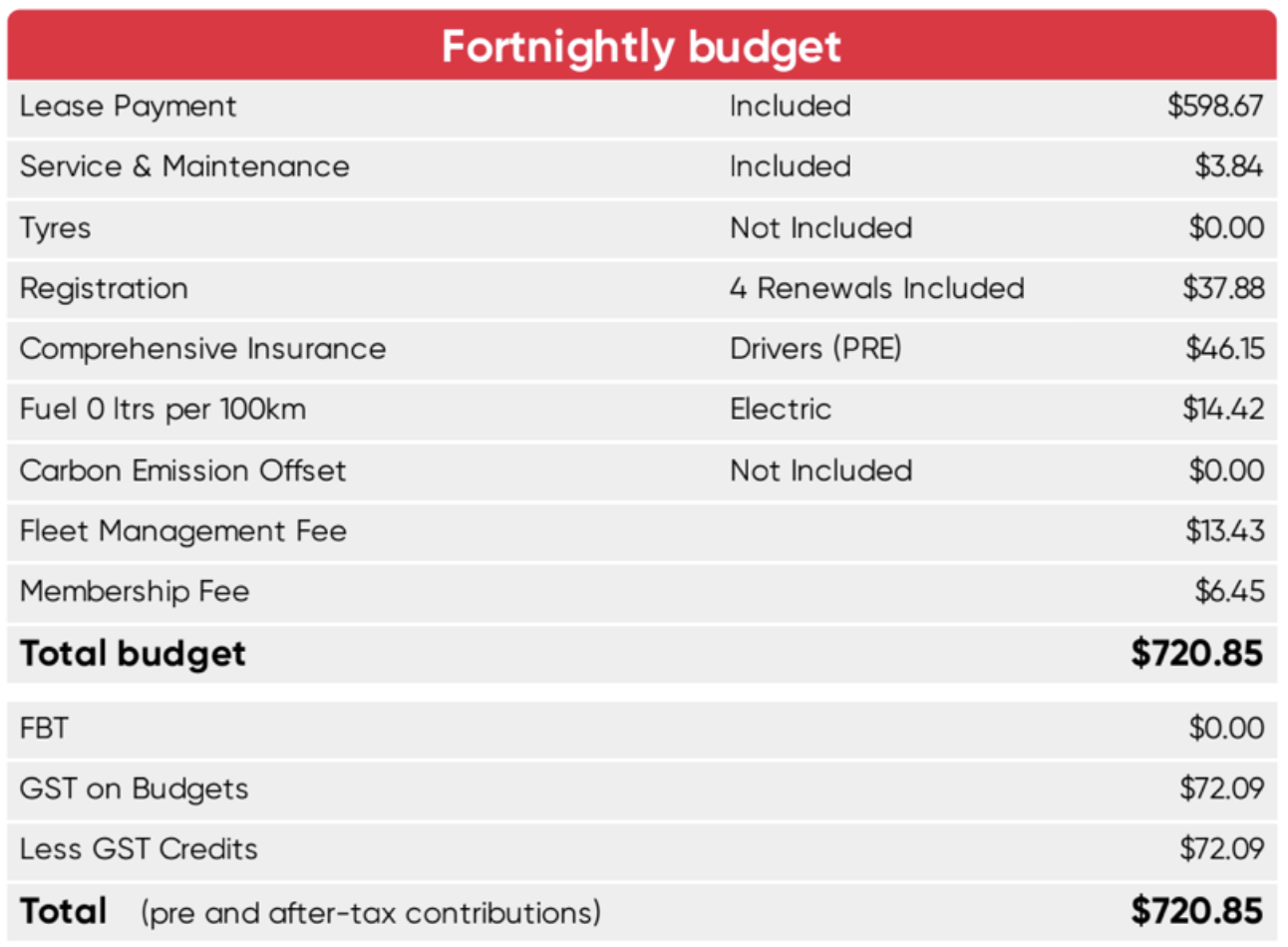

Example 2: GST savings are passed on

Green flags include explicit GST itemisation and a matching credit.

For example:

- the quote itemises GST explicitly: $72.09 GST on a subtotal of $720.85,

- it then immediately deducts “less GST credits” of $72.09,

- the total remains $720.85, confirming that figures are calculated exclusive of GST and the credit is returned to the employee.

Conclusion: GST credits are being passed on.

Why employers do this

From the employer’s perspective:

- it reduces the administrative complexity,

- it may quietly produce a financial gain,

- or is simply “how it’s always been done”.

From the employee’s perspective:

- it is a real lost benefit,

- and one that is rarely highlighted or explained.

The key takeaway

If you remember nothing else:

A novated lease only saves GST if your employer actually passes the GST credit on to you.

Do not assume this happens automatically.

Check your quote. A 10% leakage on running costs can quietly undo a meaningful chunk of the benefit you thought you were getting.

Support this independent calculator & guide

This calculator and guide are built and continuously maintained as an independent project.

If it has helped you think more clearly, avoid a costly mistake, or saved you meaningful money, you’re welcome to support its ongoing maintenance and improvements:

- Using my Tesla referral link for a $350 discount if you’re ordering a Tesla, or

- Buying me a cuppa ☕ to help cover hosting, development time, and future improvements.