Risk mitigation strategies for early termination

This article builds on the discussion of early termination and the risk of high payouts.

There are three primary strategies to mitigate this risk:

- splitting the lease into 1 year + extension

- "lease protection" type insurance

- ensuring car insurance covers the payout

All of these strategies involve trade-offs. None of them eliminate risk entirely; they only reduce its magnitude.

Lease-splitting reduces the maximum damage during early termination

If job security is a concern, one practical risk‑mitigation strategy is to avoid committing to a long lease upfront, and instead consider structures such as 1 + 4 years (or similar).

One of the biggest caveats of a novated lease is the outsized payout required if the lease has to be terminated prematurely, as discussed earlier.

Understanding why 1 + 4 helps requires understanding how residual values behave.

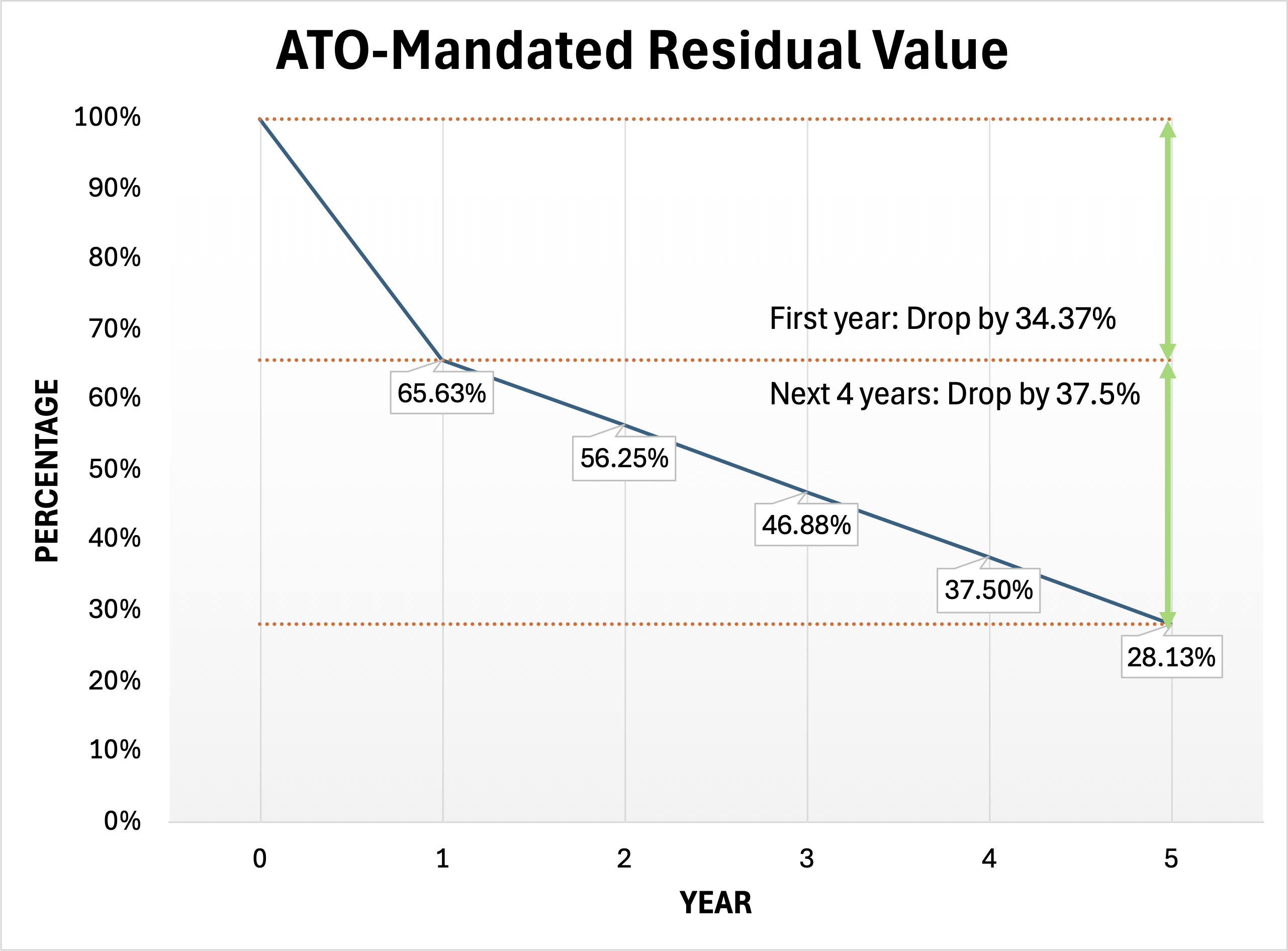

Residual values do not fall linearly

Residual values are not linear over time.

Under the ATO residual framework:

- At the end of year 1, the residual drops 34.37% from 100%:

- Year 1 → 65.63%

- Each subsequent year, the residual drops by a further 9.37% / 9.38% (depending on rounding):

- Year 2 → 56.25%

- Year 3 → 46.88%

- Year 4 → 37.50%

- Year 5 → 28.13%

Notice the asymmetry:

- the first year alone accounts for a 34.37% reduction, whereas

- the next four years combined account for a further 37.5% reduction.

This asymmetry is what makes shorter initial terms disproportionately important for risk control.

What is actually “at risk” in a novated lease

When you enter a novated lease, you are effectively paying down the car’s value from its original price down to the residual value using pre‑tax dollars, with financing costs attached.

You can think of this pre-tax financed portion as the “at-risk portion” — the part that causes disproportionate damage in a catastrophic early‑termination scenario.

Why?

- During normal operation, this portion is cheap because it is funded with pre‑tax income

(effectively receiving a 32%, 39%, or 47% discount depending on your tax bracket). - If the lease terminates early, the remaining balance must be paid out:

- immediately,

- using post‑tax dollars,

- at an effective interest rate that is often 8–12%, and

- with GST now payable, which was previously offset via input tax credits.

At that point, what was cheap pre‑tax finance instantly turns into an expensive lump‑sum obligation.

Why 1 + 4 materially reduces worst‑case outcomes

If you commit to a straight 5‑year lease, then from day one:

- 71.87% of the vehicle’s value

(100% − 28.13%)

sits inside this “at‑risk” structure.

If you are made redundant three months into the lease, the majority of the 71.87% effectively converts into a large, expensive post‑tax payout. In many such cases, the total amount paid can exceed what the car would have cost if purchased outright with cash.

By contrast, under a 1 + 4 structure:

- Year 1 places 34.37% of the car’s value at risk,

- as the 65.63% residual value would always have been paid using post-tax dollars and GST under a normal arrangement

- Years 2–5 place a further 37.5% at risk, after you have chosen to extend

At any point in time, the maximum exposed “at‑risk” portion is materially lower than under a straight 5‑year commitment.

In most cases, this means that even in a worst‑case early‑termination scenario, the total financial damage is no worse than a cash purchase, rather than substantially worse — which is the critical difference.

The trade‑off

The downside of shorter initial terms is straightforward:

- higher repayments in the first year

The upside is:

- reduced financial damage in the event of early termination

For people without iron‑clad job security, this could be a sensible trade.

Important: This is only one aspect of the broader trade-off between a single long lease and multiple shorter leases, which is discussed in more depth elsewhere in this guide. Pay particular attention to the timing of FBT-exemption review if you are considering FBT-exempt novated lease.

Lease protection insurance: reducing risk by paying away savings

Some novated lease providers offer so-called “lease protection insurance”.

For an additional premium (which is usually bundled into the financed amount), an insurance policy is purchased that promises to pay out part or all of the lease in certain early-termination scenarios, such as:

- redundancy,

- illness or incapacity, or

- (in some cases) parental leave or childbirth.

Like many optional insurances bundled into novated leases, this product is marketed as a way to “protect the downside”.

The protection, however, comes at a non-trivial cost. Premiums are often several thousand dollars, particularly when multiple optional insurances are accepted. When these premiums are financed as part of the lease, they also attract interest over the life of the lease. There are also limitations to lease protection, e.g. a ceiling on the payout amount.

The practical consequence is that:

downside risk is reduced by directly eroding the upside.

Whether such insurance is appropriate therefore depends on:

- the size of the remaining net saving after premiums,

- the likelihood of the insured event, and

- whether the same risk could be managed more cheaply or flexibly with alternative strategies.

Lease protection insurance may make sense for some people, but it is not “free protection”. It is a trade-off that should be evaluated explicitly, rather than accepted by default.

Ensure accident insurance payout is adequate

As discussed in the “How bad can it get?” article, if a leased vehicle is written off without new-for-old replacement (e.g. after the second year of typical policies), the default “agreed value” payout is often insufficient to cover the immediately payable remaining lease obligations stipulated by the lease.

Two main ways to help cover this shortfall are:

- manually adjusting the agreed value of the vehicle such that the payout covers the potential payout figure

- purchasing “total loss assist” type insurance

Again, similar principle applies i.e. these approaches both cause additional expense, therefore you are eroding the upside to protect the downside.

Key takeaway

If you remember nothing else:

While early termination risk can never be eliminated entirely, there are practical ways to materially reduce its impact.

Understanding that upfront turns early termination from a nasty shock into a quantifiable and mitigable risk.

Support this independent calculator & guide

This calculator and guide are built and continuously maintained as an independent project.

If it has helped you think more clearly, avoid a costly mistake, or saved you meaningful money, you’re welcome to support its ongoing maintenance and improvements:

- Using my Tesla referral link for a $350 discount if you’re ordering a Tesla, or

- Buying me a cuppa ☕ to help cover hosting, development time, and future improvements.