Lease length, residuals, and risk: choosing the right duration

Lease length is one of the most consequential choices in a novated lease.

Most discussion focuses on:

- monthly take-home pay impact, or

- total “tax saved” over the lease term.

What is often overlooked is that lease length directly controls risk exposure, particularly in the presence of policy uncertainty, employment uncertainty, and other early termination risks.

“One year is best” rule of thumb when FBT applies

The idea that “one year is always the best lease length” is a rule of thumb from the era when FBT applied to all novated leases.

It is not particularly relevant for FBT-exempt EV novated leases, at least from the perspective of theoretical numerical savings.

To understand why, it helps to decompose a novated lease into two conceptual parts.

Decomposing a novated lease into two parts

You can think of a novated lease as consisting of:

Part A — the pre-tax funded portion

The portion of the vehicle cost that is paid down using:

- pre-tax dollars,

- GST concessions,

- and (for EVs) FBT exemption,

thereby achieving genuine savings even after accounting for the financier’s effective interest margin.

Part B — the residual value

The portion of the vehicle cost that remains as a residual, which is:

- defined by the ATO,

- duration-based,

- and not influenced by how good or bad your lease deal is.

Residual values are predefined and highly asymmetric

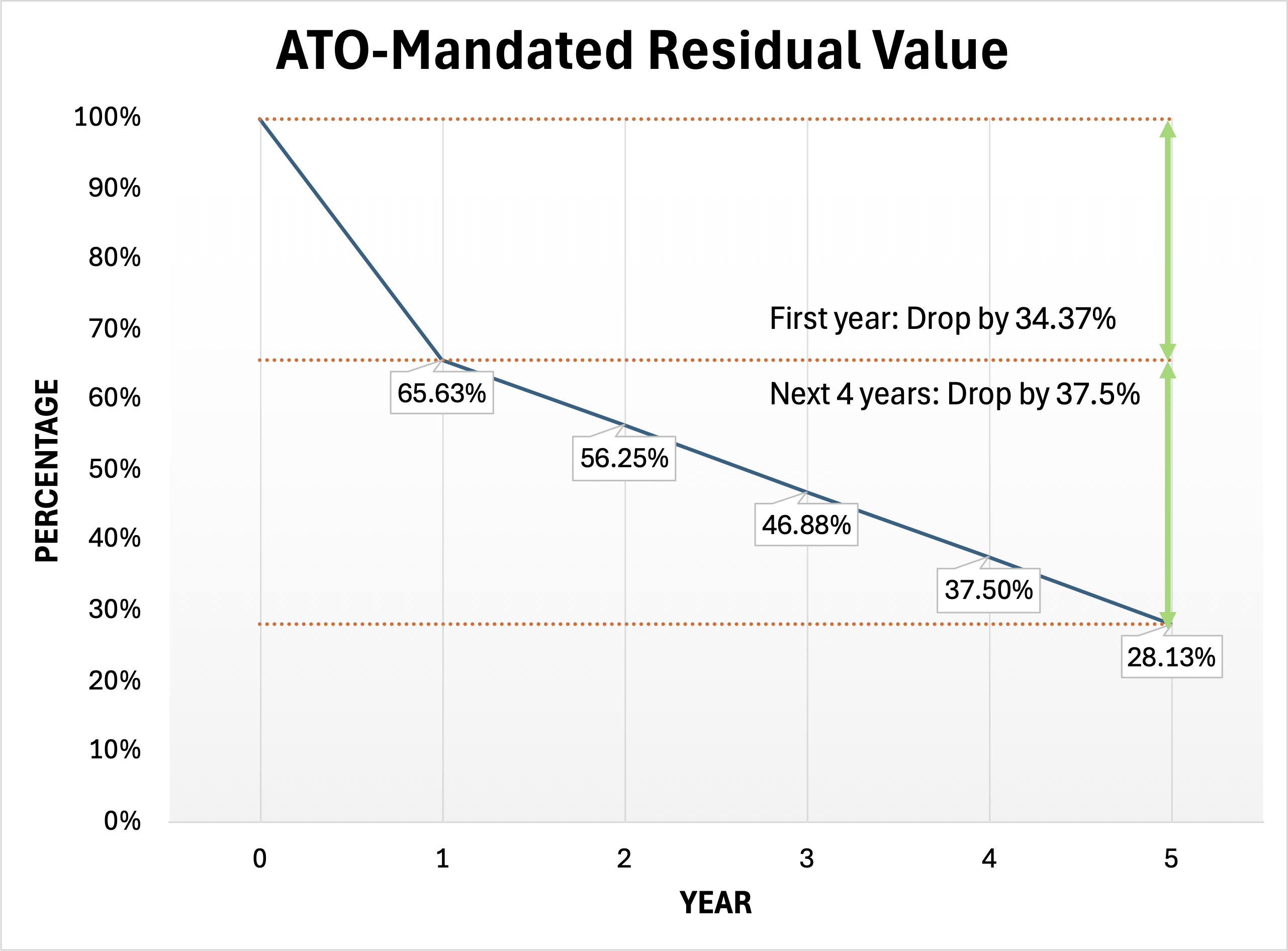

As discussed in the residual value article, Part B follows a predefined schedule:

- End of year 1 → 65.63%

- End of year 2 → 56.25%

- End of year 3 → 46.88%

- End of year 4 → 37.50%

- End of year 5 → 28.13%

The key observation is this:

- in the first year, the residual drops by 34.37%,

- in each subsequent year, it drops by only 9.37%.

Because Part A is simply the complement of Part B, this also means:

- in year 1, you get to “pay down” 34.37% of the car with pre-tax dollars (minus GST, plus effective interest),

- in each additional year, you only get an extra 9.37% of the car benefiting from the same treatment.

Each year, you also continue to enjoy:

- the running-cost “discount” equivalent to your marginal tax rate plus Medicare levy, and

- effective GST waiver (assuming your employer passes it through).

Why one year made sense when FBT applied

For FBT-applicable novated leases, there is an additional cost that applies every year after the first.

This comes from the Employee Contribution Method (ECM), which effectively forces part of the lease to be paid using post-tax dollars to neutralise FBT.

In simplified terms, this annual cost is approximately:

FBT base value × marginal tax rate × 20%

For example, for someone on a 30% + 2% marginal rate with a $60,000 FBT base value car:

60,000 × 0.32 × 0.20 = $3,840 per year

This cost recurs every year.

In the first year, this $3,840 is usually worth paying because:

- you are paying down 34.37% of the car with pre-tax dollars.

However, in subsequent years, you:

- still pay roughly the same $3,840, but

- only gain an additional 9.37% of pre-tax paydown.

This is what made extensions beyond the first year progressively less worthwhile under FBT-applicable novated leases.

(Strictly speaking, FBT is calculated on the FBT year rather than the financial year; this nuance is ignored here to keep the illustration simple.)

Why this logic breaks for EV novated leases

For FBT-exempt EV novated leases, this annual fixed cost drag no longer exists.

As a result:

- the main reason that “one year is best” existed disappears, and

- longer leases no longer suffer the same diminishing-return penalty.

If you are someone who would otherwise:

- keep the car for a long period, and

- eventually pay out the residual to own it,

then from a purely numerical perspective:

funding more of the car under an FBT-exempt novated lease

means paying down a larger proportion of the vehicle with pre-tax dollars.

Yes, longer leases mean that more interest paid overall. But in most realistic scenarios, this additional interest is outweighed by:

- the larger pre-tax-funded portion of the vehicle, and

- the ongoing running-cost tax and GST concessions.

For FBT-exempt lease, longer is always better then?

None of this means that longer is always better for FBT-exempt NL.

Theoretical savings must always be balanced against:

- higher downside risk in redundancy or early termination,

- vehicle write-off scenarios,

- policy risk (e.g. FBT exemption review),

- career flexibility,

- borrowing capacity impact etc.

FBT-exempt NL length consideration

The crux of the lease length consideration is:

Lease length determines how much of the car you get to pay down with pre-tax dollars — and also how much risk you are taking to do so.

While one-year is traditionally proposed to be the optimal length for FBT-applicable NL due to aforementioned reasons, for FBT-exempt EV novated lease, the consideration is a lot more nuanced.

Why longer leases look attractive for FBT-exempt NL

All else being equal, longer novated leases tend to look better in quotes because:

- more of the vehicle cost is funded with pre-tax income,

- GST concessions are applied for longer,

- monthly payroll deductions look smaller,

- headline “tax saved” numbers increase.

From a purely mechanical perspective, this is correct.

A 5-year lease will almost always produce greater apparent savings than a 1- or 2-year lease.

The problem is that this optimisation comes with asymmetric risk.

Lease length determines how much is “at risk”

As discussed elsewhere in this guide, residual values do not decline linearly.

Under the ATO framework:

- the first year reduces the residual by 34.37%,

- the next four years combined reduce it by a further 37.5%.

This has an important implication:

A large portion of the vehicle’s value is exposed early in the lease.

When you commit to a long lease upfront, you immediately place a substantial proportion of the car’s value inside a structure that relies on:

- continued employment,

- continued novation,

- continued tax concessions.

That exposure is cheap only while those conditions hold. However the same exposed portion is also the at-risk part which makes NL expensive in the event of early termination. In other words, these amounts drive both the magnitude of potential savings (if everything goes well) and the magnitude of potential loss (in the event of early termination).

Policy risk: the FBT-exemption may not last

Lease length also determines how exposed you are to policy change risk.

The EV FBT exemption is currently under formal review (to be completed within the 18-month period of 1/1/2026 to 1/7/2027). 1 At the conclusion of the review, the government will decide whether to:

- extend,

- modify, or

- discontinue the exemption.

If the exemption were to end:

- existing leases are very likely to be grandfathered until the end of their contract, but

- new leases or extensions would not enjoy the exemption.

This matters for lease structure:

- a straight 5-year lease locks in today’s rules for the full term,

- a 1 + 1 + 1 + 1 structure exposes each renewal to future policy change.

If the exemption ends, repeated short renewals could dramatically reduce total savings.

Early termination and worst-case outcomes

Lease length also governs the severity of worst-case scenarios, such as:

- redundancy,

- employer change,

- prolonged unpaid leave, or

- a vehicle write-off where insurance does not fully cover the payout.

As explained in detail in the early termination section, early termination can cause:

- loss of income tax savings,

- loss of GST concessions,

- immediate crystallisation of residual exposure.

Longer leases concentrate more value inside this at-risk structure earlier.

Shorter initial leases materially limit the size of that exposure.

(For a detailed discussion of the risk-mitigation strategy, see the early termination page.)

"Getting more tax benefit earlier" and "paying down more of the car" is good for sure?

A common intuition is that:

- paying more earlier must reduce total interest over the car's lifetime.

- "you get more "tax benefit in the first year!

This is only half the story.

While higher early repayments may reduce the total financing costs on the lease side, they also:

- reduce your offset or cash balance earlier and for longer,

- increase home loan interest over the same period.

When both effects are modelled properly, they largely counteract each other.

Therefore, the other factors earlier matter far more than "paying more of the car earlier".

Paying down more of the car with repeated 65.63% residualisation

Under the ATO’s clarified position (TD 93/142 addendum, 2021):

- when leases are extended (e.g. 1 + 1 + 1),

- the residual must continue to follow the original residual table, based on the original vehicle value.

Some novated lease providers still apply a compounding residual method (e.g. repeatedly applying 65.63% to the prior residual).

This allows more of the vehicle to be paid down using pre-tax dollars and increases apparent savings.

However:

- this approach is legally questionable, and

- it introduces compliance risk that sits entirely with the employee.

Career-path risk: the junior doctor example

Lease length should also reflect career structure.

For example, junior doctors who plan to undertake overseas fellowship or training often must:

- terminate Australian employment,

- lose novation,

- and immediately settle the remaining lease using post-tax dollars.

In this context, long upfront leases can be particularly hazardous.

Shorter initial terms may sacrifice some optimisation but materially reduce the risk of a forced payout at an inopportune time.

When a long upfront lease might still be reasonable

A longer upfront lease may still make sense if:

- employment is highly stable,

- there is no plan for property purchase during the lease duration,

- the individual has strong liquidity or borrowing capacity,

- the downside risk of vehicle write-off etc is considered +/- mitigated.

Such a decision must be arrived at after deliberate and broad risk/benefit consideration encompassing all of the factors discussed earlier.

The correct way to choose lease length

The wrong question is:

“Which lease length maximises the saving?”

The right question is:

“How much risk am I willing to accept in exchange for additional potential saving?”

Key takeaway

If you remember nothing else:

There is no one "best duration". The optimal duration depends on the lease's FBT-exemption status, employment, and termination risk.

The right lease length is individual, and must be arrived at after considering all the dimensions of upsides and downsides.

Support this independent calculator & guide

This calculator and guide are built and continuously maintained as an independent project.

If it has helped you think more clearly, avoid a costly mistake, or saved you meaningful money, you’re welcome to support its ongoing maintenance and improvements:

- Using my Tesla referral link for a $350 discount if you’re ordering a Tesla, or

- Buying me a cuppa ☕ to help cover hosting, development time, and future improvements.

-

It is not unclear whether the review would last the entire duration. Therefore it is theoretically possible for the review process to be completed within 2026 itself and recommendation to terminate (for example) to be tabled to parliament prior to 2027. ↩